Top Car Insurance Providers with the Best Quotes in 2025

Discover the top car insurance providers in 2025 offering the best quotes for drivers. These companies are known for their competitive pricing, comprehensive coverage options, and excellent customer service. Whether you're looking for basic liability or full coverage, these providers stand out in the market, ensuring you get the best value for your money while protecting your vehicle.

When it comes to safeguarding your vehicle, choosing the right car insurance provider is crucial. With **car insurance rates** fluctuating every year, it’s essential to find a provider that offers the best quotes while ensuring comprehensive coverage. In 2025, several insurance companies stand out in terms of affordability, customer service, and coverage options. Below, we explore the top car insurance providers that offer the best quotes this year.

1. Geico

Geico consistently ranks among the top car insurance providers due to its competitive rates and user-friendly online services. Known for its iconic advertising, Geico offers a variety of discounts, including those for safe drivers and multi-policy holders. In 2025, the average quote for a basic policy with Geico is approximately **$1,200** annually.

2. State Farm

State Farm remains a leading choice for many drivers thanks to its extensive network of agents and customizable coverage options. In 2025, State Farm's average quote stands at around **$1,300** per year. The company is known for its stellar customer service and claims handling, making it a reliable option for many insured drivers.

3. Progressive

Progressive is renowned for its innovative approach to **auto insurance** and its competitive pricing. In 2025, drivers can expect an average quote of about **$1,250** annually. Progressive also offers a unique tool called the Name Your Price tool, allowing customers to find coverage that fits within their budget while still meeting their insurance needs.

4. Allstate

Allstate is another prominent player in the car insurance market, providing a wide range of coverage options and discounts. In 2025, the average premium for an Allstate policy is approximately **$1,350**. Allstate emphasizes personalized service through local agents, making it a great choice for those who prefer face-to-face interactions.

5. USAA

For military members and their families, USAA offers some of the best car insurance rates available. In 2025, the average quote from USAA is around **$1,100**, making it one of the most affordable options. USAA is also praised for its exceptional customer service and claims support, ensuring peace of mind for its policyholders.

6. Farmers Insurance

Farmers Insurance is known for its flexible policy options and numerous discounts, including for bundling home and auto insurance. The average quote for Farmers in 2025 is roughly **$1,400** per year. Their comprehensive coverage options allow customers to tailor their policies according to their unique needs.

7. Nationwide

Nationwide offers competitive pricing and a broad range of coverage options, making it a solid choice for many drivers. The average annual premium in 2025 is approximately **$1,280**. Nationwide is particularly well-known for its vanishing deductible program, which rewards safe driving habits with lower deductibles over time.

Comparison Chart of Top Car Insurance Providers in 2025

| Insurance Provider | Average Annual Quote |

|---|---|

| Geico | $1,200 |

| State Farm | $1,300 |

| Progressive | $1,250 |

| Allstate | $1,350 |

| USAA | $1,100 |

| Farmers Insurance | $1,400 |

| Nationwide | $1,280 |

Factors Affecting Car Insurance Quotes

When searching for the best car insurance quotes, it’s important to understand that several factors can influence your rates. These include:

- Driving History: A clean driving record typically results in lower premiums.

- Location: Insurance rates can vary significantly based on where you live.

- Type of Vehicle: The make and model of your car can impact your insurance costs.

- Coverage Level: Comprehensive coverage will usually cost more than basic liability coverage.

- Credit Score: In many states, insurers consider credit history when determining rates.

Conclusion

Finding the right car insurance provider with the best quotes in 2025 requires thorough research and consideration of your specific needs. With options like Geico, State Farm, and USAA leading the way, consumers have access to competitive pricing and reliable coverage. By comparing quotes and understanding the factors that influence rates, you can make an informed decision that protects your vehicle and your wallet.

Explore

Top Car Insurance Options for New Drivers in 2025: Affordable Coverage & Essential Tips

Navigating the Road to Savings: A Comprehensive Guide to Car Insurance

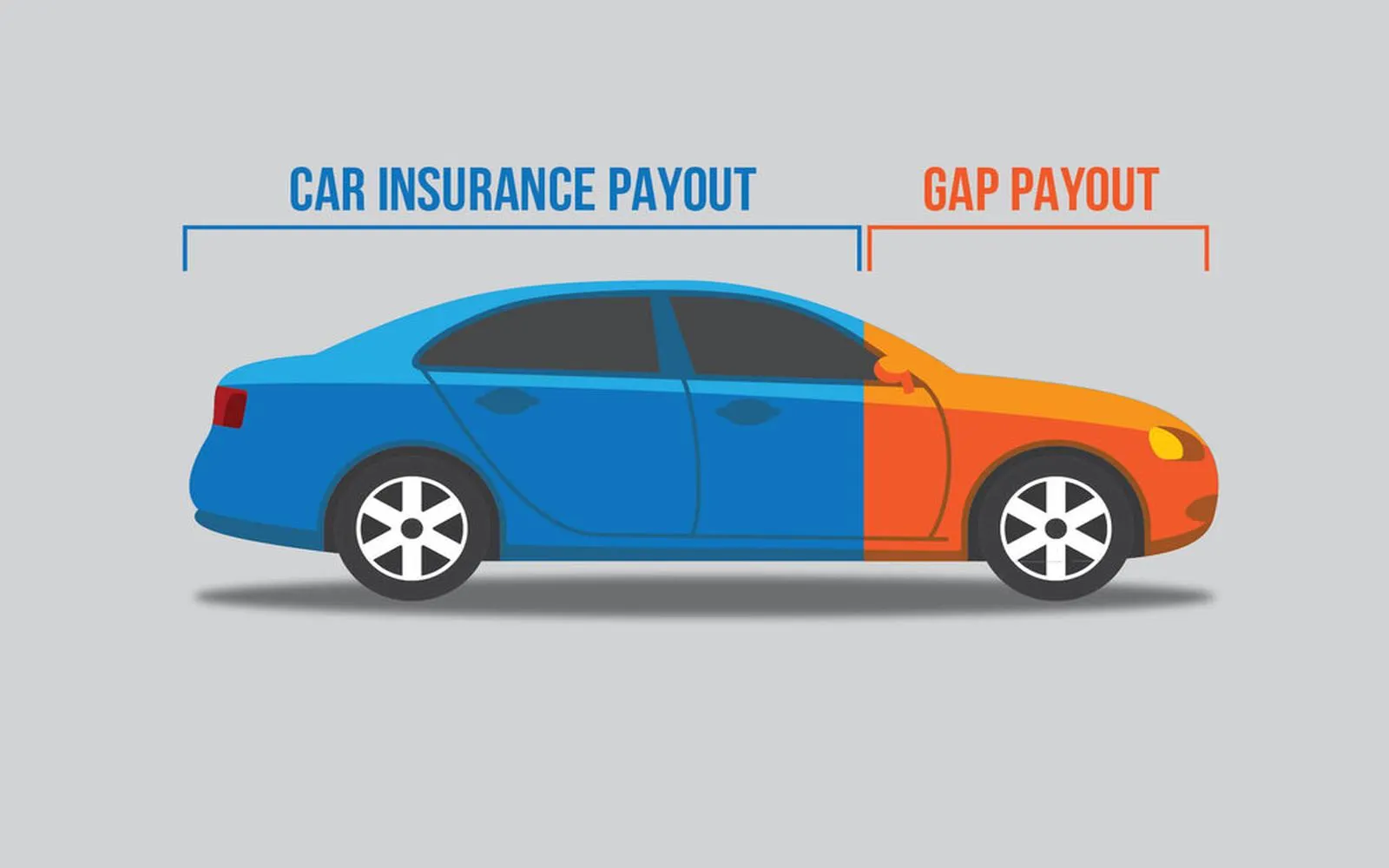

Unlocking Peace of Mind: The Essential Guide to Gap Insurance

Obtaining Insurance Quotes Without Car Information: A Comprehensive Guide

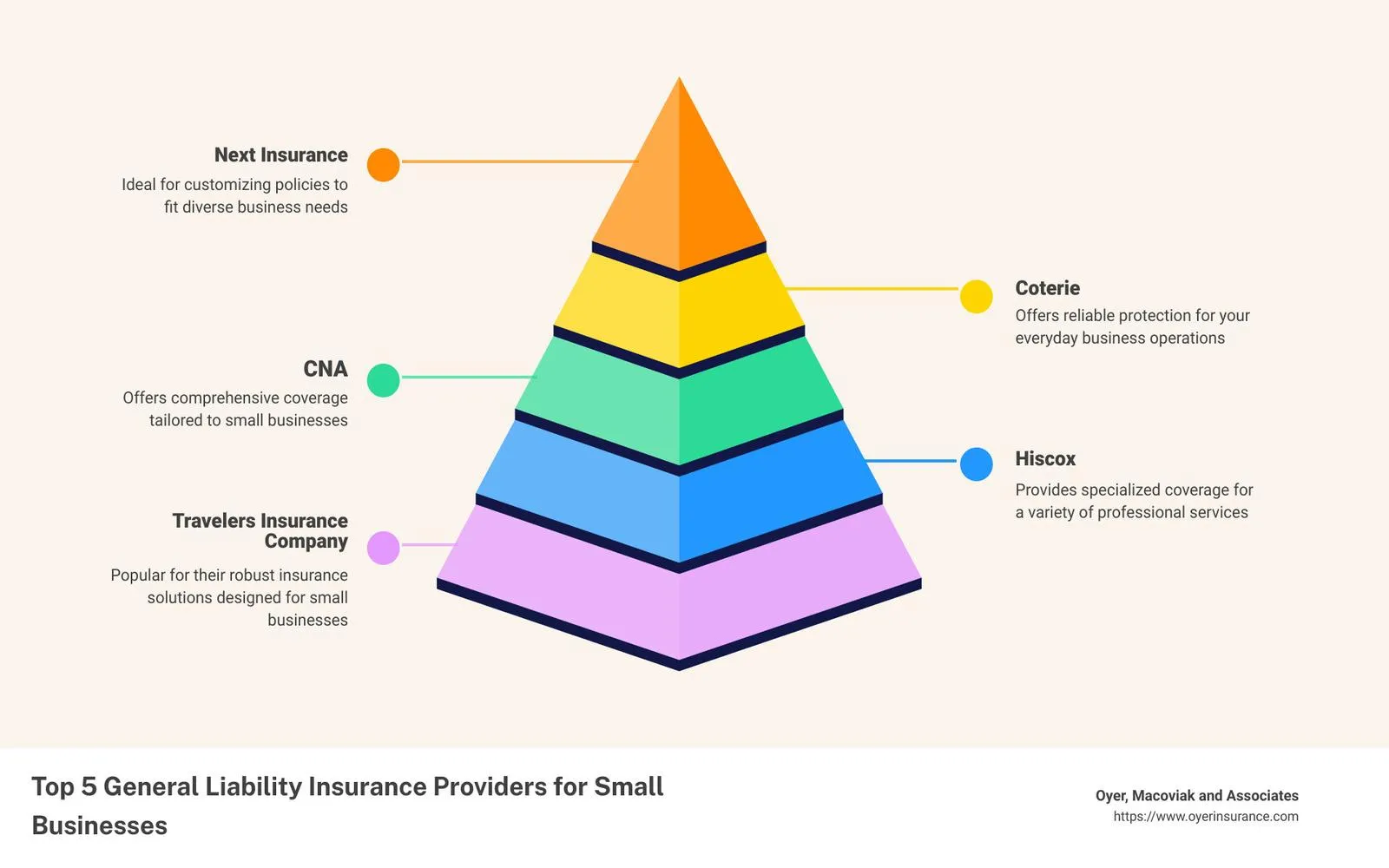

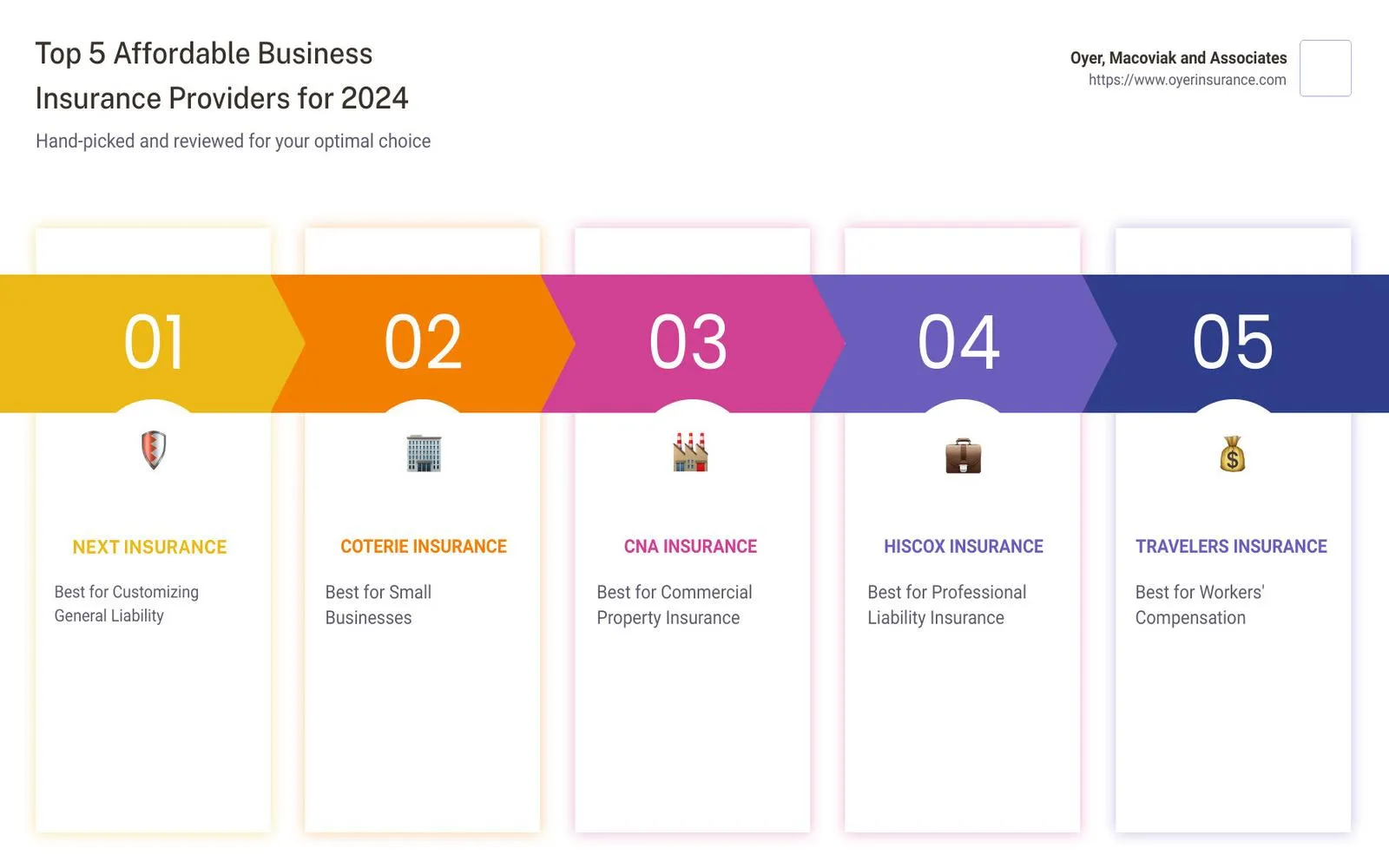

Business Liability Insurance Providers: Protecting Your Business from Risks

Top 2025: Cheapest Pet Insurance Providers for Affordable Coverage

Top Business Insurance Providers of 2025: Secure Your Future with the Best Coverage Options

Explore Business Insurance Providers of 2025: Ensure Your Company’s Future Security