Unlocking Peace of Mind: The Essential Guide to Gap Insurance

When it comes to purchasing a vehicle, most buyers are aware of the importance of standard auto insurance. However, many overlook the crucial role that gap insurance can play in safeguarding their financial future. Gap insurance is designed to cover the difference between what you owe on a vehicle and its actual cash value in the event of theft or a total loss. This guide will walk you through the essentials of gap insurance, helping you unlock peace of mind in your automotive journey.

Understanding Gap Insurance

To fully appreciate the value of gap insurance, it’s important to understand how it works. When you finance or lease a vehicle, the amount you owe can often exceed its market value, especially in the early years of ownership. This is due to depreciation, which causes a vehicle’s value to drop significantly as soon as it leaves the dealership. If your vehicle is declared a total loss, standard insurance will only cover the current market value, leaving you responsible for the remaining balance on your loan or lease. This is where gap insurance comes into play.

Who Needs Gap Insurance?

Gap insurance is not for everyone, but certain situations make it an essential purchase. If you financed a large portion of your vehicle or made a small down payment, the likelihood of being upside down on your loan increases. Additionally, if you own a new vehicle that depreciates quickly, gap insurance can provide protection. Leasing a car is another scenario where gap insurance is often recommended since lease agreements typically require insurance coverage that accounts for potential financial liabilities.

Benefits of Gap Insurance

Investing in gap insurance can offer several benefits that contribute to your peace of mind. Here are some key advantages:

- Financial Protection: Gap insurance covers the difference between the actual cash value of your vehicle and the amount you owe. This means you won’t be left with a hefty bill if your car is totaled.

- Affordability: Gap insurance is generally more affordable than many people think. The cost can vary based on the insurer and your vehicle value, but it often ranges from $20 to $50 per year.

- Flexible Coverage: Many car dealerships and insurance companies offer customizable gap insurance plans, allowing you to choose the coverage that best fits your needs.

- Peace of Mind: Knowing that you’re protected against unexpected financial burdens allows you to enjoy your vehicle without the constant fear of depreciation and debt.

How to Purchase Gap Insurance

There are several ways to purchase gap insurance. Here are the most common options:

- Through Your Lender or Dealer: Many auto dealerships and lenders offer gap insurance as part of the vehicle financing package. While this can be convenient, make sure to compare prices and terms with other options.

- From an Insurance Provider: Many auto insurance companies offer standalone gap insurance policies. This option often allows for better rates and terms, making it worth researching different providers.

- Credit Unions and Banks: Some financial institutions also provide gap insurance, sometimes at a reduced cost for members. If you’re part of a credit union or bank, inquire about their offerings.

Common Misconceptions About Gap Insurance

Despite the clear benefits, several misconceptions about gap insurance can lead to confusion. Here are a few common myths debunked:

- Myth 1: Gap Insurance is Only for New Cars: While new vehicles are more likely to require gap insurance due to higher depreciation rates, used cars can also benefit if there is a significant financing gap.

- Myth 2: My Standard Insurance Policy Covers Everything: Standard auto insurance does not cover the difference between your loan balance and your vehicle’s value. Gap insurance is specifically designed to fill that gap.

- Myth 3: Gap Insurance is a Waste of Money: For many people, the protection that gap insurance provides is well worth the cost, especially for those with high loan balances or vehicles that depreciate rapidly.

Conclusion

In the world of vehicle ownership, gap insurance serves as a vital safety net that can safeguard your finances against unforeseen circumstances. By understanding its purpose, benefits, and the options available for purchase, you can make an informed decision that enhances your peace of mind. Whether you’re financing a new car or leasing a vehicle, investing in gap insurance can help ensure that you’re not left holding the bag if the worst happens. Don’t overlook this essential coverage in your quest for financial security on the road.

Explore

Top Car Insurance Options for New Drivers in 2025: Affordable Coverage & Essential Tips

Navigating the Road to Savings: A Comprehensive Guide to Car Insurance

Top Car Insurance Providers with the Best Quotes in 2025

Unlocking Business Success: The Essential Role of Registered Agent Services

Top Vacation Rental Insurance Options for 2025: Protect Your Investment and Enjoy Peace of Mind

Navigating Legal Waters: How Settlement Agreement Attorneys Can Secure Your Peace of Mind

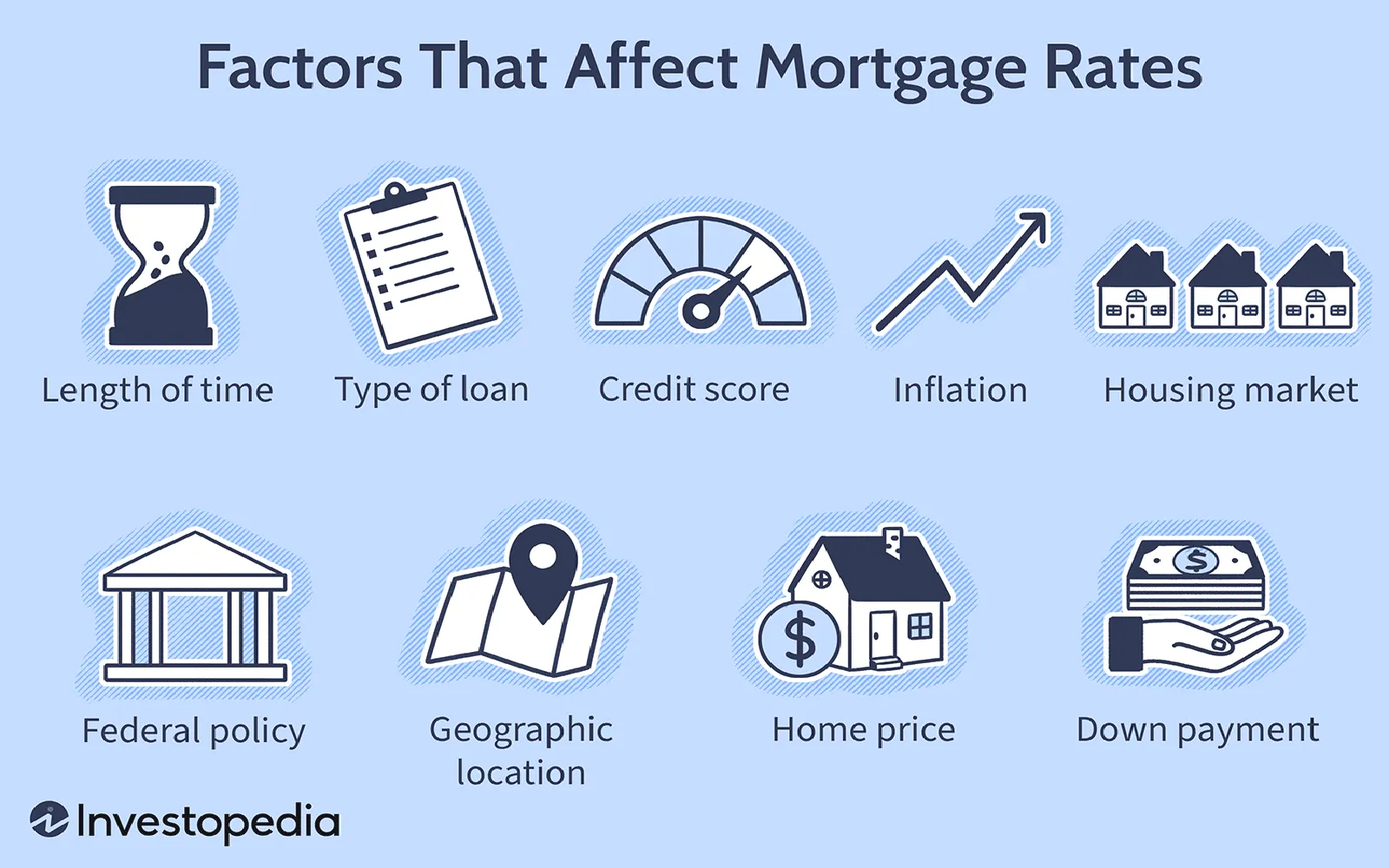

Unlocking Low-Interest Mortgages in 2025: Essential Tips for Homebuyers

Navigating Health Insurance in 2025: Essential Tips for Coverage and Savings