Mobile Investment Apps Changing the Game in 2025

In 2025, mobile investment apps are revolutionizing the financial landscape by offering unprecedented access to investment opportunities. With advanced features like AI-driven analytics and user-friendly interfaces, these apps empower users to make informed decisions. As a result, more individuals are engaging in personal finance, democratizing wealth-building and reshaping the future of investing.

The landscape of investing has dramatically transformed in recent years, and by 2025, mobile investment apps are set to change the game even further. With the proliferation of smartphones and advancements in technology, these apps are making investing more accessible, efficient, and user-friendly than ever before. In this article, we will explore how mobile investment apps are reshaping the financial landscape, the benefits they offer, and the potential challenges that may arise.

Accessibility and Inclusivity

One of the most significant advantages of mobile investment apps is their ability to democratize investing. Traditionally, investing was seen as a domain reserved for the wealthy or those with extensive financial knowledge. However, with the rise of these apps, anyone with a smartphone can start investing with minimal barriers to entry. In 2025, we expect that even more people will embrace investing due to the ease of access provided by these platforms.

According to a recent survey, the number of individuals using mobile investment apps is projected to increase by 30% by 2025. This surge in users will largely be driven by younger generations, who are more inclined to use technology for financial management. The chart below illustrates the anticipated growth in mobile investment app users over the next few years:

| Year | Projected Users (in millions) |

|---|---|

| 2023 | 150 |

| 2024 | 195 |

| 2025 | 250 |

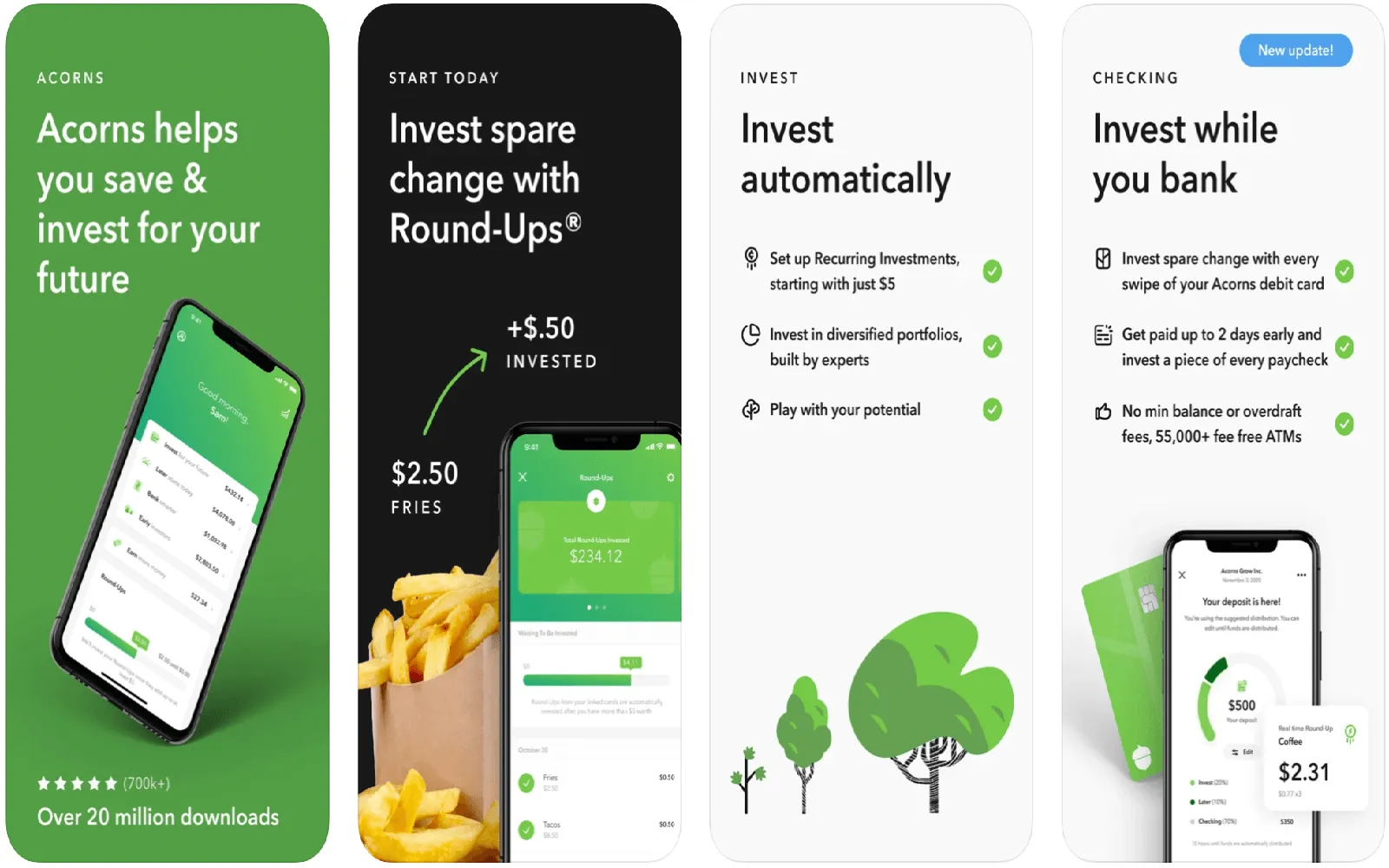

User-Friendly Interfaces and Features

As competition among mobile investment apps intensifies, developers are focusing on enhancing user experience. Intuitive interfaces and innovative features make it easier for users to navigate through investment options. Features such as real-time market data, personalized investment recommendations, and educational resources will become standard in 2025.

Furthermore, many apps now incorporate advanced technologies like artificial intelligence to provide users with tailored insights based on their investment habits. This level of personalization will empower investors to make informed decisions, even if they are new to the market.

Robo-Advisors and Automated Investing

The integration of robo-advisors in mobile investment apps is another trend that will gain traction by 2025. Robo-advisors use algorithms to manage investment portfolios, providing users with a hands-off approach to investing. This is particularly appealing to younger investors who may prefer a more passive investment strategy.

With automated investing, users can set their risk tolerance and investment goals, and the robo-advisor will handle the rest. This automation not only saves time but also reduces the emotional stress often associated with investing.

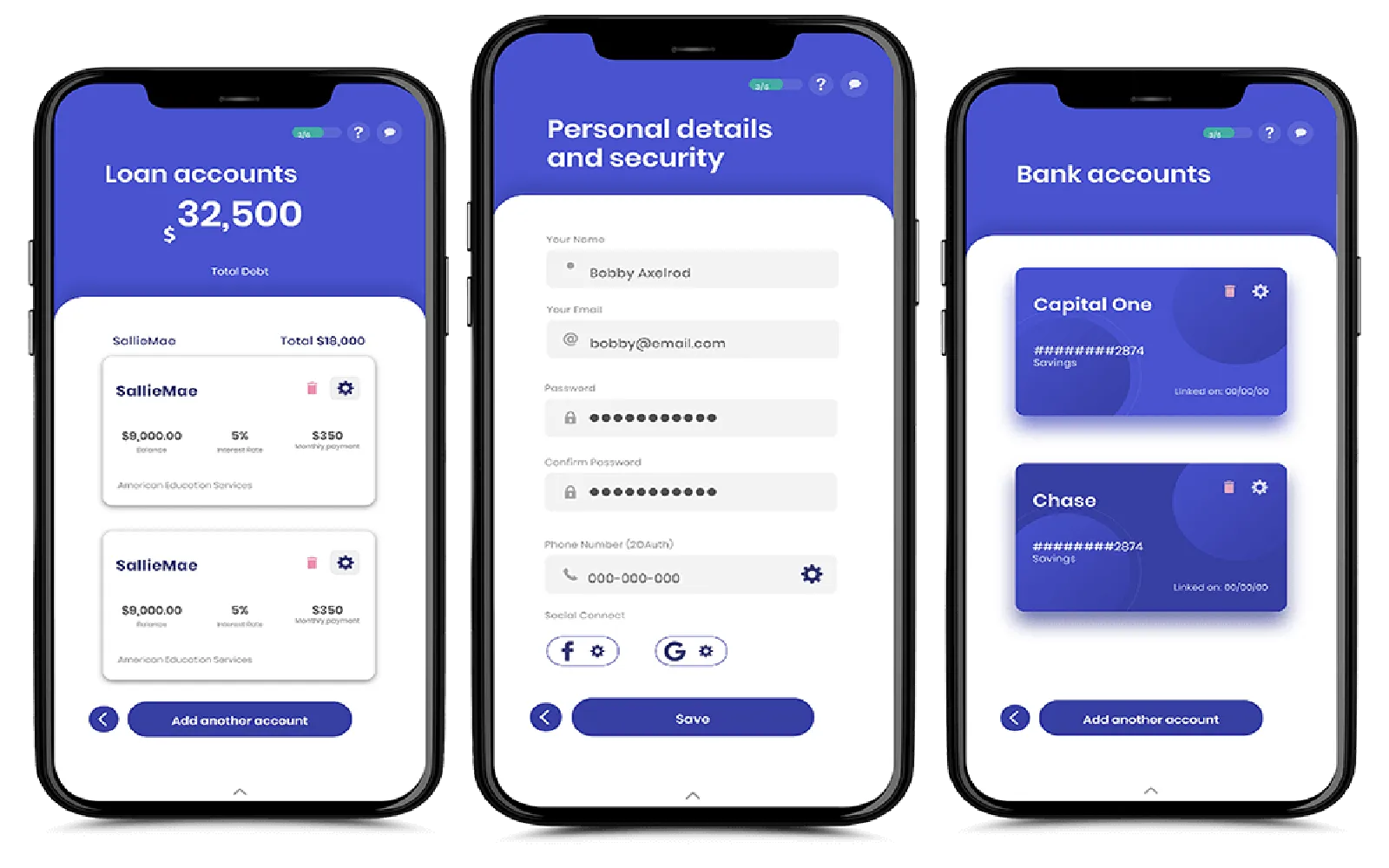

Security and Regulatory Challenges

While the benefits of mobile investment apps are clear, there are also challenges that users and developers must navigate. Security remains a top concern, as these apps handle sensitive financial information. By 2025, we expect to see significant advancements in security features, including enhanced encryption and biometric authentication methods.

Additionally, as these apps continue to grow in popularity, regulatory scrutiny will increase. Governments may introduce new regulations to protect investors, especially with the rise of social investing and robo-advisors. Adapting to these regulatory changes will be crucial for app developers aiming to maintain user trust and comply with the law.

Conclusion

In conclusion, mobile investment apps are set to revolutionize the investment landscape by 2025. Their accessibility, user-friendly interfaces, social features, and automated investing capabilities will attract a new generation of investors. However, addressing security challenges and adapting to regulatory changes will be essential for the continued success of these platforms. As technology evolves, so too will the ways we invest, making the future of investing more inclusive and engaging than ever before.

Explore

How to Start Developing Your Own Mobile App

Top Investment Apps for Beginners in 2025: Your Guide to Smart Investing

Mastering Evony: The Ultimate Game Guide to Conquer and Thrive

Trends in Temp Work: How Agencies Are Changing This Year

Future of Mobile Technology: Top Cellphone Trends and Innovations to Watch in 2025

Top Fintech Apps of 2025: Manage Your Money Like a Pro

Top Mutual Fund Trends to Watch in 2025: Maximize Your Investment Potential

Top Fund Management Software and Tools to Streamline Your Investment Strategy in 2025

Social Investing and Community Engagement

In 2025, social investing will be a major trend within mobile investment apps. These platforms will integrate social features that allow users to follow and interact with other investors, share their strategies, and discuss market trends. This sense of community can help novice investors gain confidence and knowledge by learning from experienced peers.

Moreover, some apps may incorporate social trading features, allowing users to replicate the trades of successful investors. This approach can demystify the investment process for beginners, making them more likely to participate actively in the market.