Top Fintech Apps of 2025: Manage Your Money Like a Pro

Discover the top fintech apps of 2025 that empower you to manage your money like a pro. These innovative tools offer features such as budgeting, investment tracking, and personal finance management, helping you make informed financial decisions. Embrace cutting-edge technology to streamline your finances and achieve your financial goals with ease and efficiency.

The financial technology sector has seen remarkable growth in recent years, with new applications emerging that empower users to manage their finances more effectively. As we look ahead to 2025, it's essential to identify the top fintech apps that can help you manage your money like a pro. Here’s a detailed overview of the most promising apps, their key features, and how they can benefit your financial journey.

1. Mint

Mint continues to be a leading personal finance app, allowing users to track their spending, create budgets, and manage bills effortlessly. With its user-friendly interface, Mint categorizes expenses automatically, providing users with a clear picture of their financial health. The app also offers insights and tips to help users save more effectively.

2. YNAB (You Need A Budget)

YNAB has gained a loyal following due to its proactive budgeting approach. This app encourages users to allocate every dollar they earn to specific expenses, helping them live within their means. YNAB's unique methodology teaches users about budgeting principles, making it an excellent choice for those looking to gain control over their finances.

3. Robinhood

Robinhood revolutionized the stock trading landscape by offering commission-free trades. In 2025, it continues to provide an easy way for beginners to invest in stocks, ETFs, and cryptocurrencies. With its sleek design and educational resources, Robinhood makes investing accessible, encouraging users to build their wealth over time.

4. Cash App

Cash App has transformed the way users handle peer-to-peer transactions. Launched by Square, it allows users to send and receive money instantly, making it a convenient tool for everyday transactions. In addition to its core functionality, Cash App offers features like investing in stocks and Bitcoin, making it a versatile financial tool.

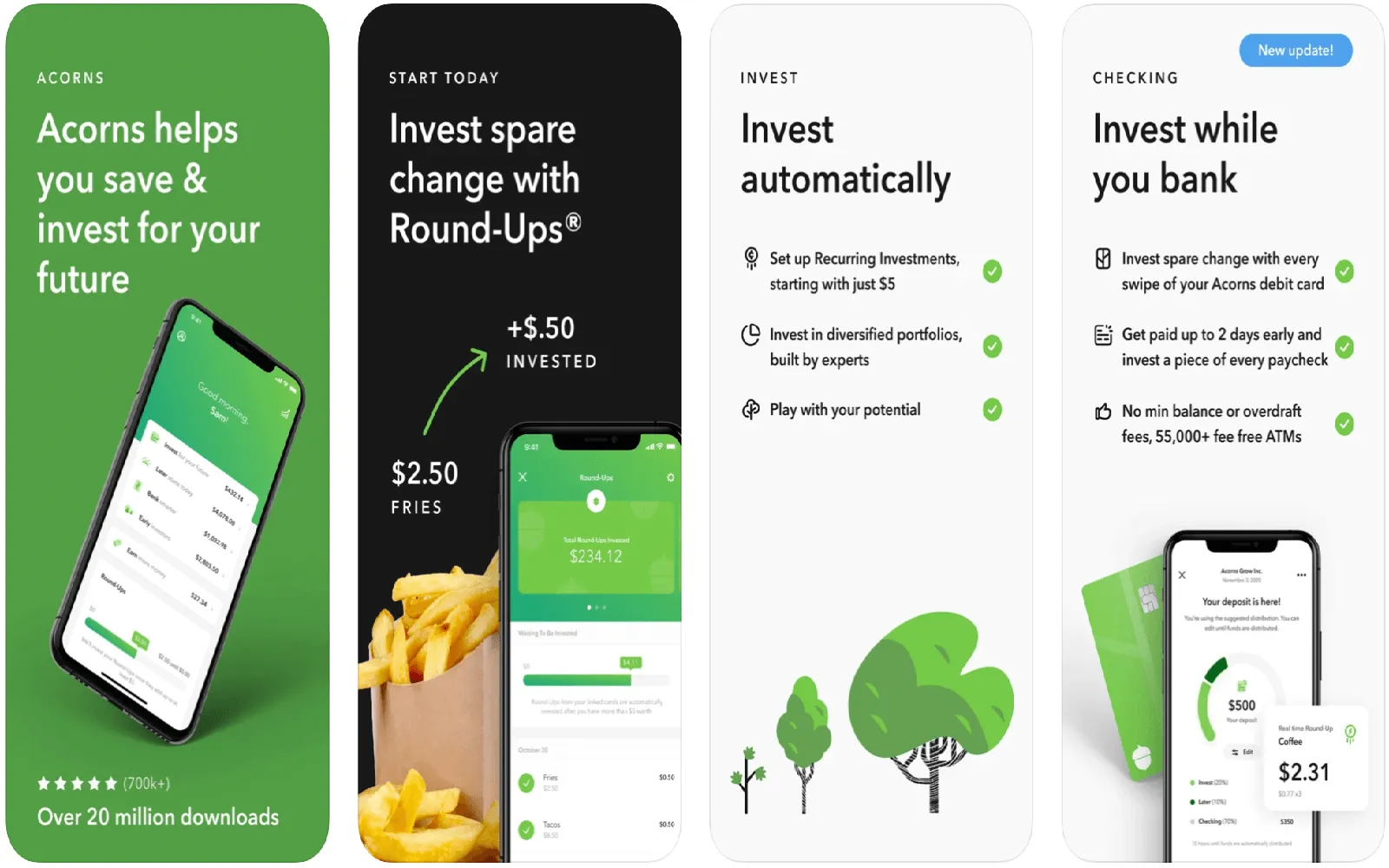

5. Acorns

Acorns is perfect for users who want to invest but may not have a lot of money to start. This app rounds up your purchases to the nearest dollar and invests the spare change, making investing a seamless part of everyday life. Acorns also offers educational content to help users understand the investment process.

6. Chime

Chime is a neobank that offers users a fee-free banking experience. With features like automatic savings and early direct deposit, Chime helps users save money effortlessly. Its user-friendly app provides real-time transaction notifications, making it easier to track spending and maintain budgets.

7. Personal Capital

Personal Capital excels in wealth management and investment tracking. It allows users to see all their financial accounts in one place, providing a comprehensive view of their net worth. With its retirement planning tools and personalized investment advice, Personal Capital is ideal for those looking to grow their wealth strategically.

8. SoFi

SoFi is a multifaceted financial platform that offers everything from student loans to investment services. The app provides users with access to financial education resources, making it easier for them to make informed decisions regarding their finances. SoFi also offers unique benefits like career coaching and networking opportunities.

Comparison Chart of Top Fintech Apps

| App | Key Features | Best For |

|---|---|---|

| Mint | Expense tracking, budgeting | Personal finance management |

| YNAB | Proactive budgeting | Budgeting education |

| Robinhood | Commission-free trading | Beginner investors |

| Cash App | P2P transactions, investing | Everyday transactions |

| Acorns | Round-up investing | New investors |

| Chime | Fee-free banking, automatic savings | Banking without fees |

| Personal Capital | Wealth management tools | Investment tracking |

| SoFi | Loans, investment services | Comprehensive financial services |

Conclusion

As we move towards 2025, the landscape of personal finance is evolving rapidly. These top fintech apps provide a range of tools and resources to help users take charge of their financial lives. Whether you're looking to budget better, invest wisely, or manage your banking needs, there's an app on this list for you. Embrace these technologies and manage your money like a pro!

Explore

Get Your Dream Home: How to Sell Your House Fast and Move On to Your Next Adventure

Top Investment Apps for Beginners in 2025: Your Guide to Smart Investing

Mobile Investment Apps Changing the Game in 2025

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth

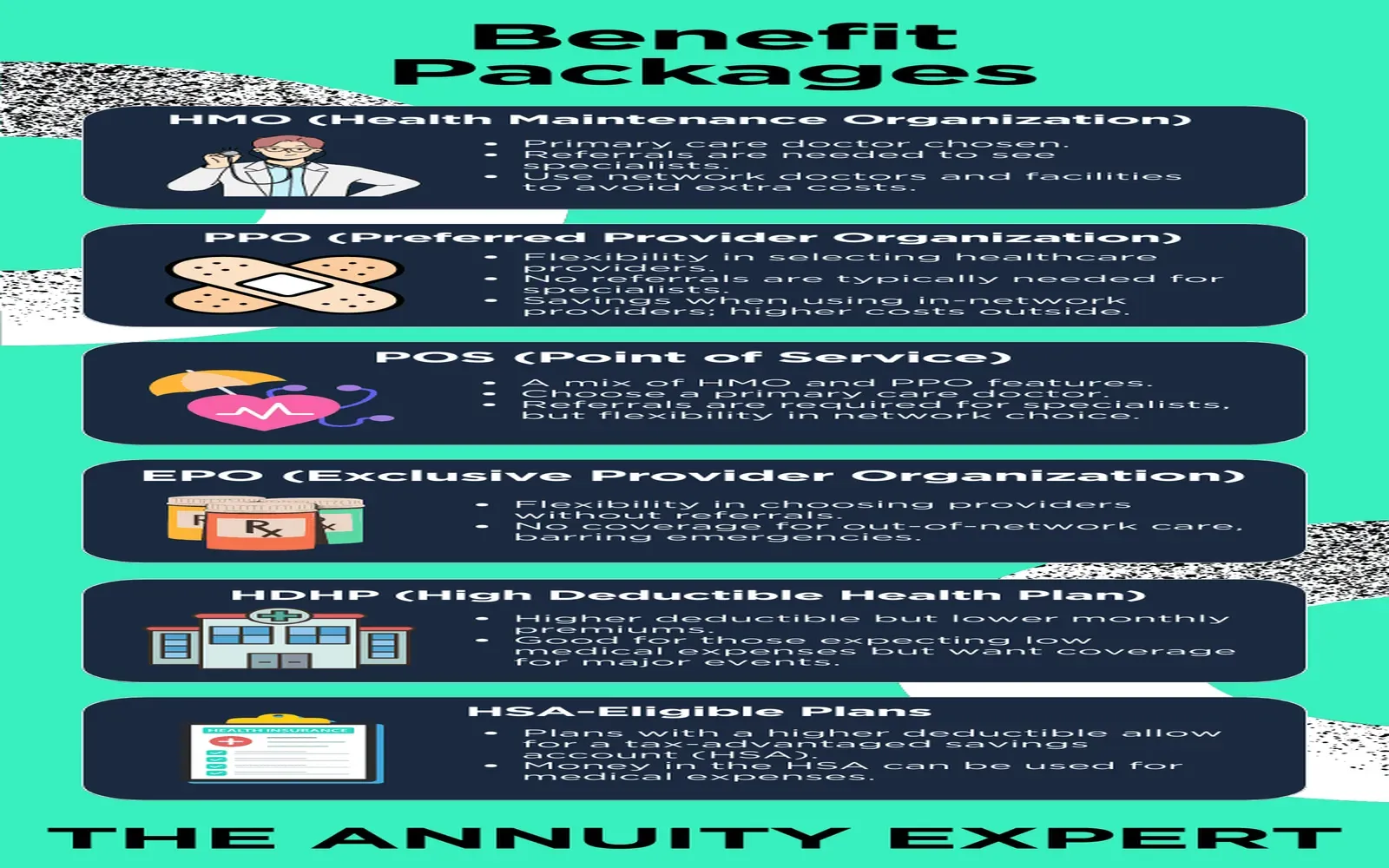

Affordable Business Health Insurance Plans for 2025: Save Money While Protecting Your Team

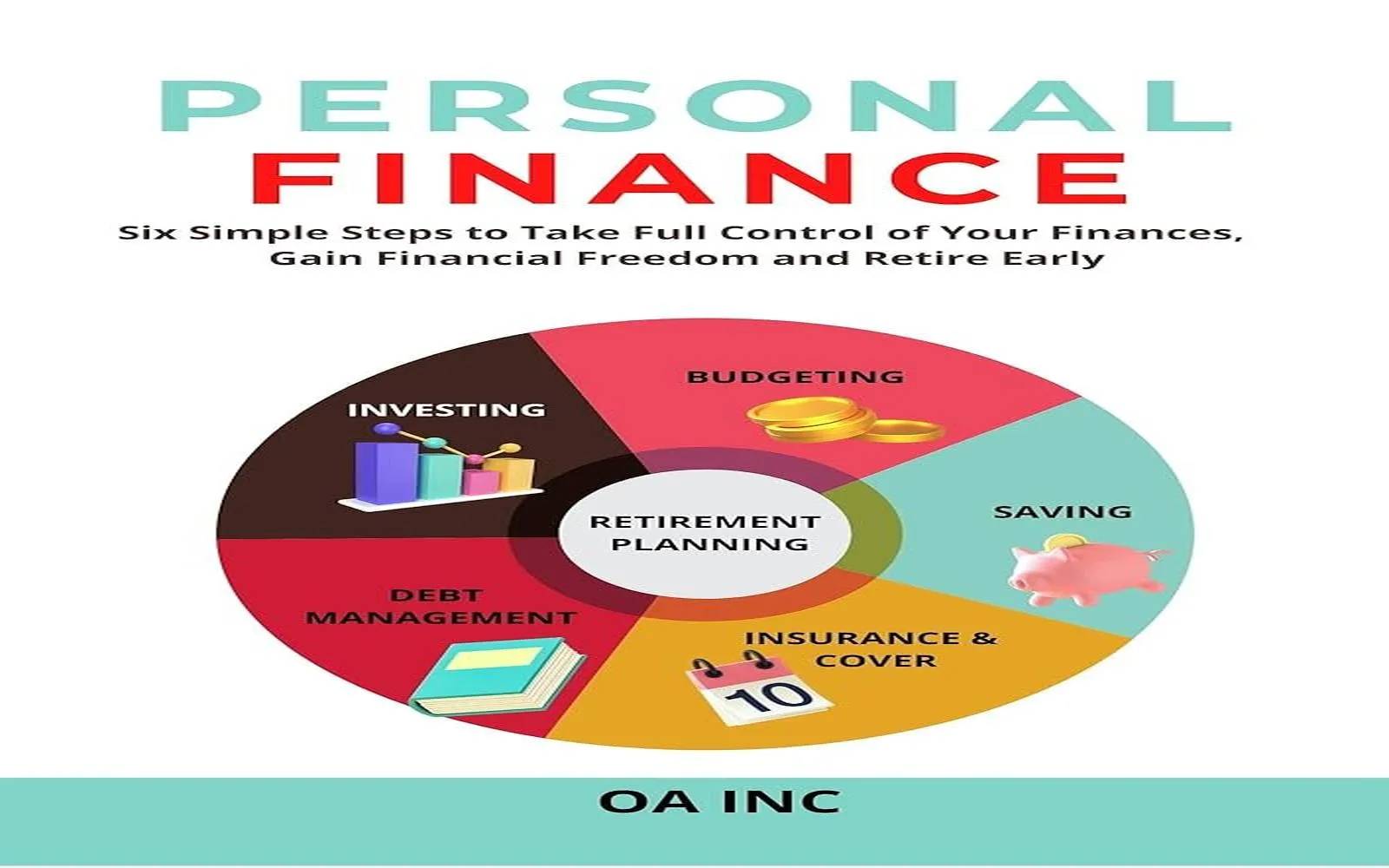

Master Your Money: Essential Personal Finance Strategies for 2025

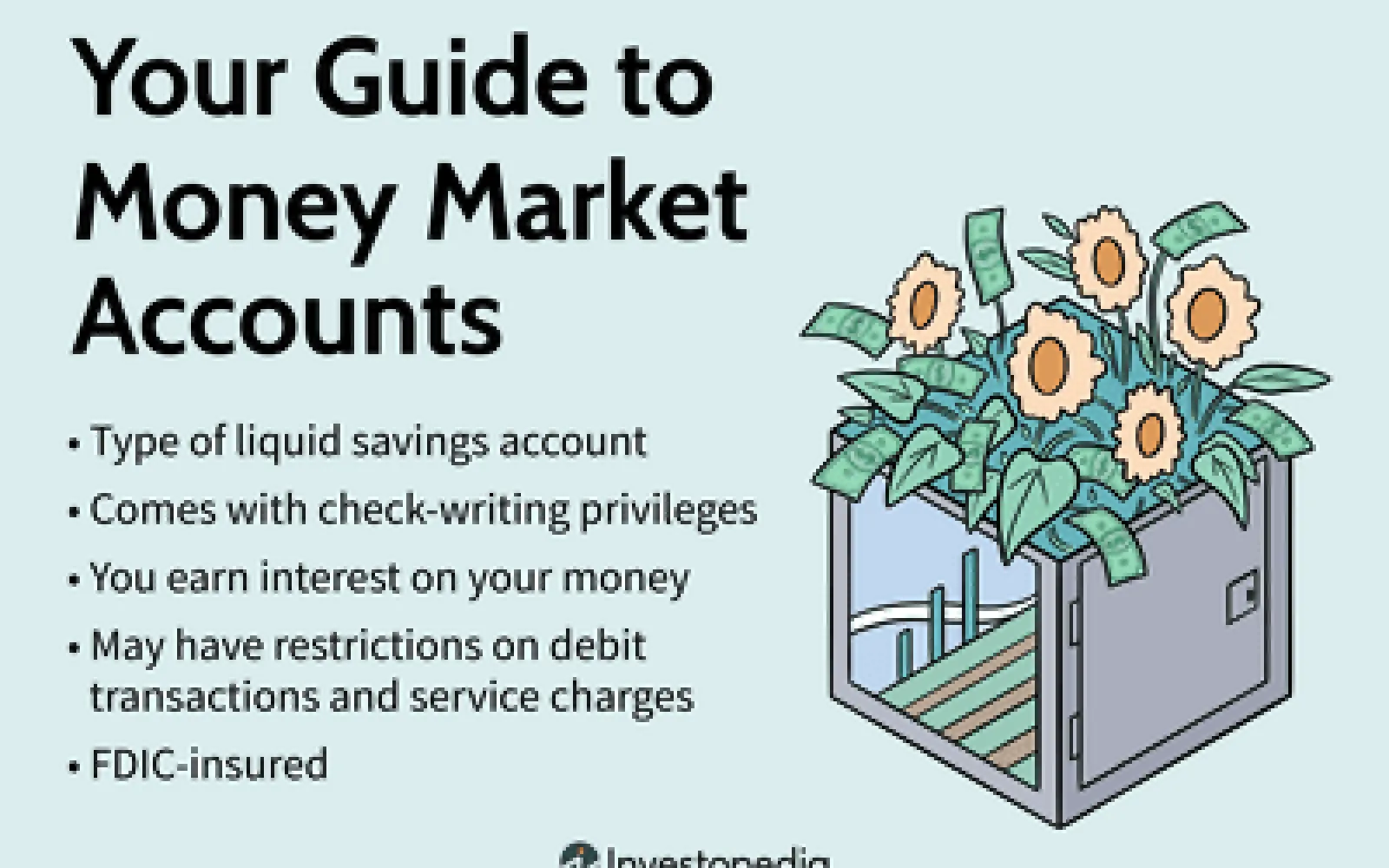

Money Market Funds: Smart Savings for Short-Term Goals

Top Business Loans for Women Entrepreneurs in 2025: Unlock Your Potential and Grow Your Business