Guide to Finding the Best Retirement Advisor for 2025

Finding the best retirement advisor for 2025 requires thorough research and careful consideration. Start by assessing their credentials and experience in retirement planning. Look for fiduciary advisors who prioritize your interests. Read reviews and seek recommendations to gauge their reputation. Finally, schedule consultations to ensure their approach aligns with your financial goals and values.

Why You Need a Retirement Advisor

As you approach retirement, the decisions you make regarding your finances become increasingly crucial. A skilled retirement advisor can help you navigate the complexities of retirement planning, ensuring that you achieve your financial goals while minimizing risks. With the year 2025 approaching, it's essential to find the right advisor who can provide tailored strategies to meet your unique needs.

What to Look for in a Retirement Advisor

Choosing the best retirement advisor involves several key considerations. Here are some factors to keep in mind:

1. Credentials and Certifications

Look for advisors with relevant credentials such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Retirement Income Certified Professional (RICP). These designations indicate a high level of expertise and a commitment to ethical practices.

2. Experience

Experience matters. An advisor with several years in the industry will have dealt with various market conditions and client scenarios. They will be better equipped to provide sound advice relevant to your situation.

3. Fee Structure

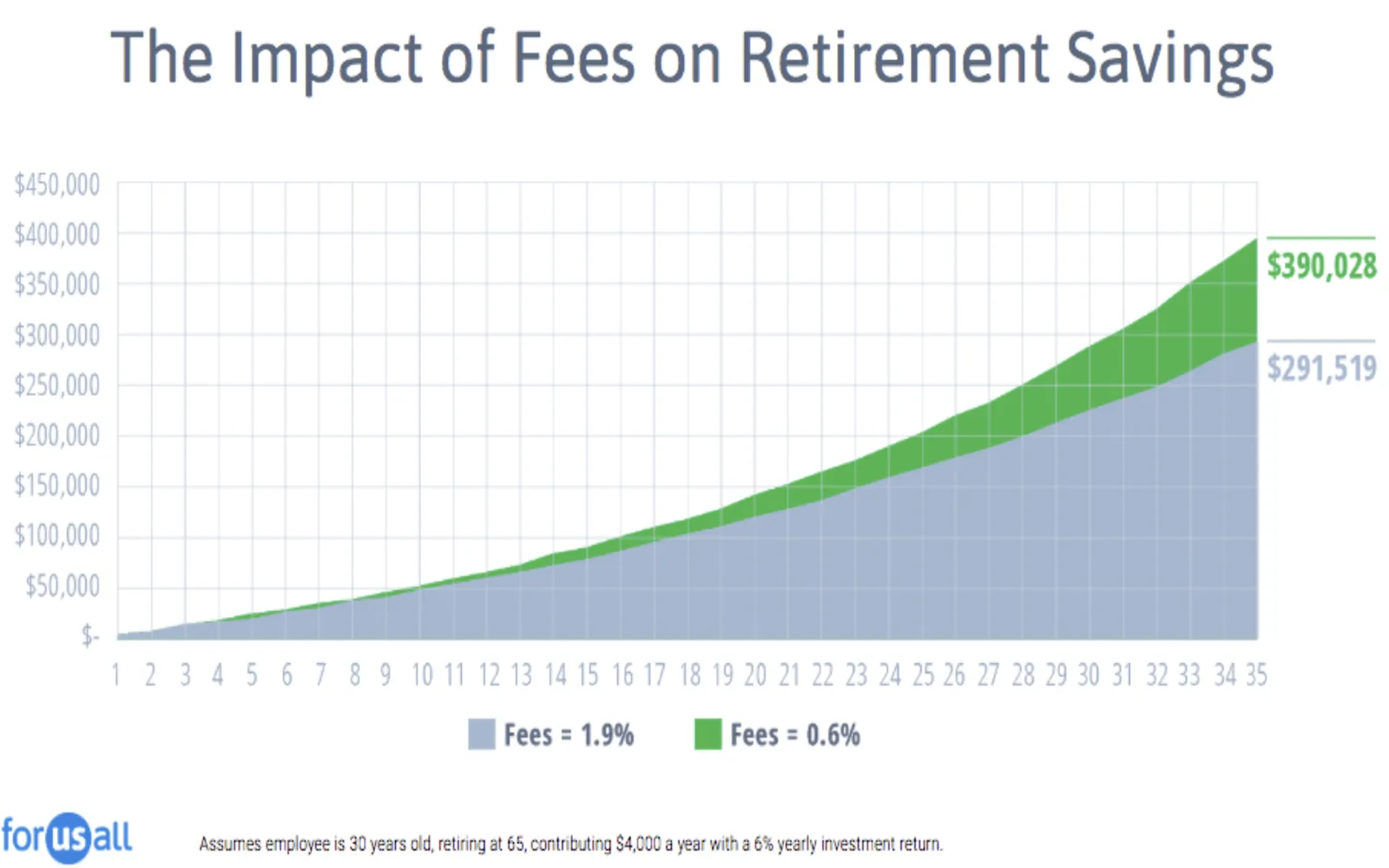

Understanding an advisor's fee structure is crucial. Some advisors charge a flat fee, while others work on a commission basis. Make sure you are comfortable with how they charge for their services and that it aligns with your financial situation.

4. Fiduciary Duty

Choose an advisor who operates under a fiduciary duty. This means they are legally obligated to act in your best interests, ensuring that their advice is not driven by commissions or personal gain.

5. Investment Philosophy

Different advisors have different investment philosophies. Some may favor aggressive growth strategies, while others may prioritize capital preservation. Ensure that their approach aligns with your risk tolerance and retirement goals.

The Importance of Personal Fit

Finding an advisor isn't just about qualifications; it's also about personal fit. You will be sharing sensitive financial information and discussing your future aspirations, so it's vital to find someone you can trust and communicate effectively with.

Steps to Find the Right Retirement Advisor

Here’s a step-by-step guide to help you find the best retirement advisor for 2025:

Step 1: Research

Start your search online. Websites like the National Association of Personal Financial Advisors (NAPFA) and the Financial Planning Association (FPA) can help you find qualified advisors in your area.

Step 2: Create a Shortlist

Compile a list of potential advisors based on your research. Narrow it down to about three to five candidates to make the selection process manageable.

Step 3: Conduct Interviews

Schedule consultations with your shortlisted advisors. Prepare questions to gauge their expertise, style, and approach. Ask about their experience with clients in similar situations to yours.

Step 4: Verify Their Background

Use resources like FINRA's BrokerCheck or the SEC's Investment Adviser Public Disclosure database to verify their credentials, disciplinary history, and professional background.

Step 5: Review the Contract

Before making a final decision, review the advisor's contract carefully. Ensure that you understand their fees, services provided, and any other terms. Don’t hesitate to ask for clarification on anything you find confusing.

Chart: Questions to Ask Potential Retirement Advisors

Below is a chart of essential questions to consider during your advisor interviews:

| Question | Purpose |

|---|---|

| What are your qualifications and experience? | To assess expertise and credibility |

| How do you charge for your services? | To understand the fee structure |

| Are you a fiduciary? | To ensure they prioritize your interests |

| What is your investment philosophy? | To evaluate alignment with your risk tolerance |

| Can you provide references from clients? | To gauge client satisfaction and success |

Conclusion

Finding the best retirement advisor for 2025 requires careful consideration and research. By focusing on credentials, experience, fee structures, and personal fit, you can make an informed decision that aligns with your retirement goals. Remember to take your time during this process, as the right advisor can significantly impact your financial well-being in retirement.

Explore

Finding Justice: Your Guide to the Best Personal Injury Lawyers Near You

Swift and Reliable: Your Ultimate Guide to Finding the Best Plumbers Near You

How to Choose a Robo Advisor: Smart Wealth Tools in 2025

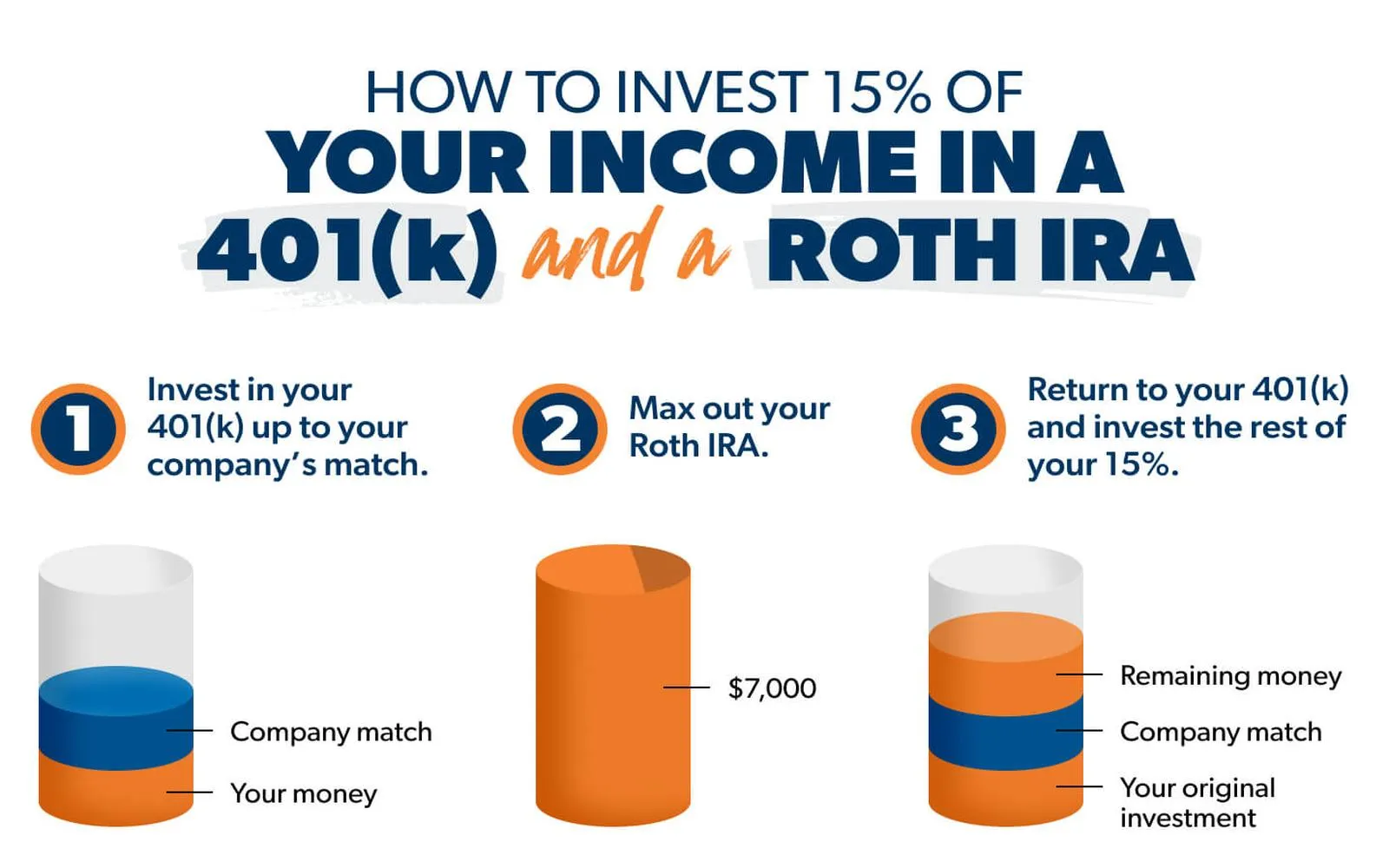

Top Roth IRA Options for 2025: Secure Your Retirement with the Best Plans

Top 401(k) Providers with Low Fees for 2025: Maximize Your Retirement Savings

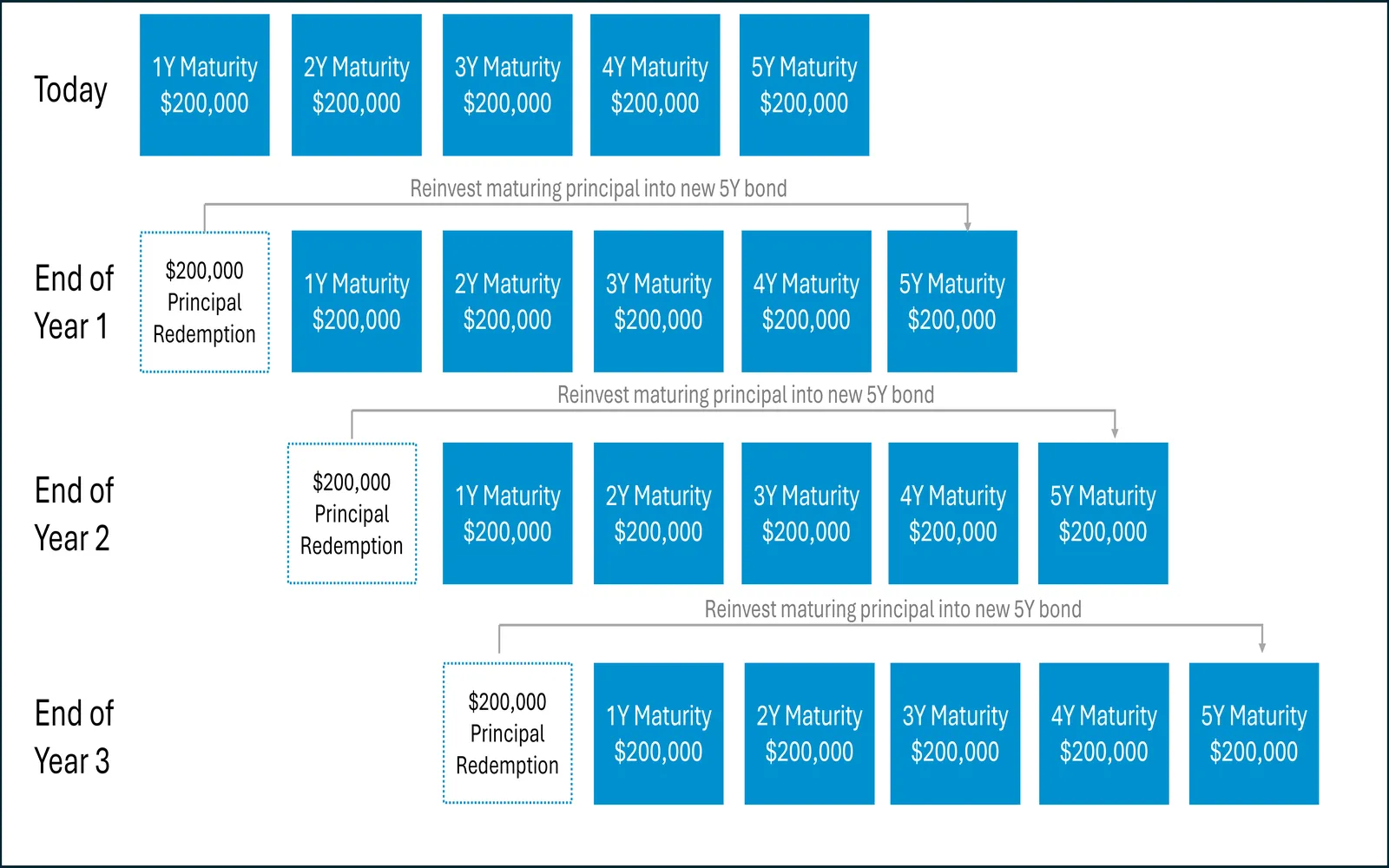

How to Use Bond Ladders for Stable Retirement Income in 2025

Finding the Right Local Law Firm: A Guide for U.S. Residents

Top 10 Tips for Finding Reliable Plumbers Near Me in 2025