How to Choose a Robo Advisor: Smart Wealth Tools in 2025

Choosing a robo advisor in 2025 requires careful consideration of several factors. Look for platforms that offer personalized investment strategies, low fees, and strong customer support. Evaluate their performance tracking tools and ensure they align with your financial goals. Additionally, check for user-friendly interfaces and available automated services to enhance your overall investing experience.

As we approach 2025, the investment landscape continues to evolve, making it essential for investors to stay informed about the latest tools available. One of the most significant advancements in personal finance is the rise of robo-advisors. These automated platforms offer a variety of services that cater to both novice and seasoned investors. However, choosing the right robo-advisor can feel overwhelming due to the multitude of options available. Here’s an insightful guide to help you make an informed decision.

Understanding Robo-Advisors

Robo-advisors are digital platforms that provide automated financial planning services with minimal human supervision. They typically use algorithms and data analysis to create and manage investment portfolios based on individual investor preferences. In 2025, these platforms will integrate even more advanced technology, such as artificial intelligence and machine learning, making them smarter and more personalized.

Key Features to Consider

When evaluating different robo-advisors, it’s crucial to consider the following features:

- Investment Strategy: Understand the investment strategies employed by the platform. Some may focus on low-cost index funds, while others may incorporate alternative investments.

- Fees: Compare the fees associated with different robo-advisors. Look for transparent pricing structures, as high fees can eat into your returns over time.

- Account Minimums: Different platforms have varying account minimum requirements. Choose one that aligns with your investment capacity.

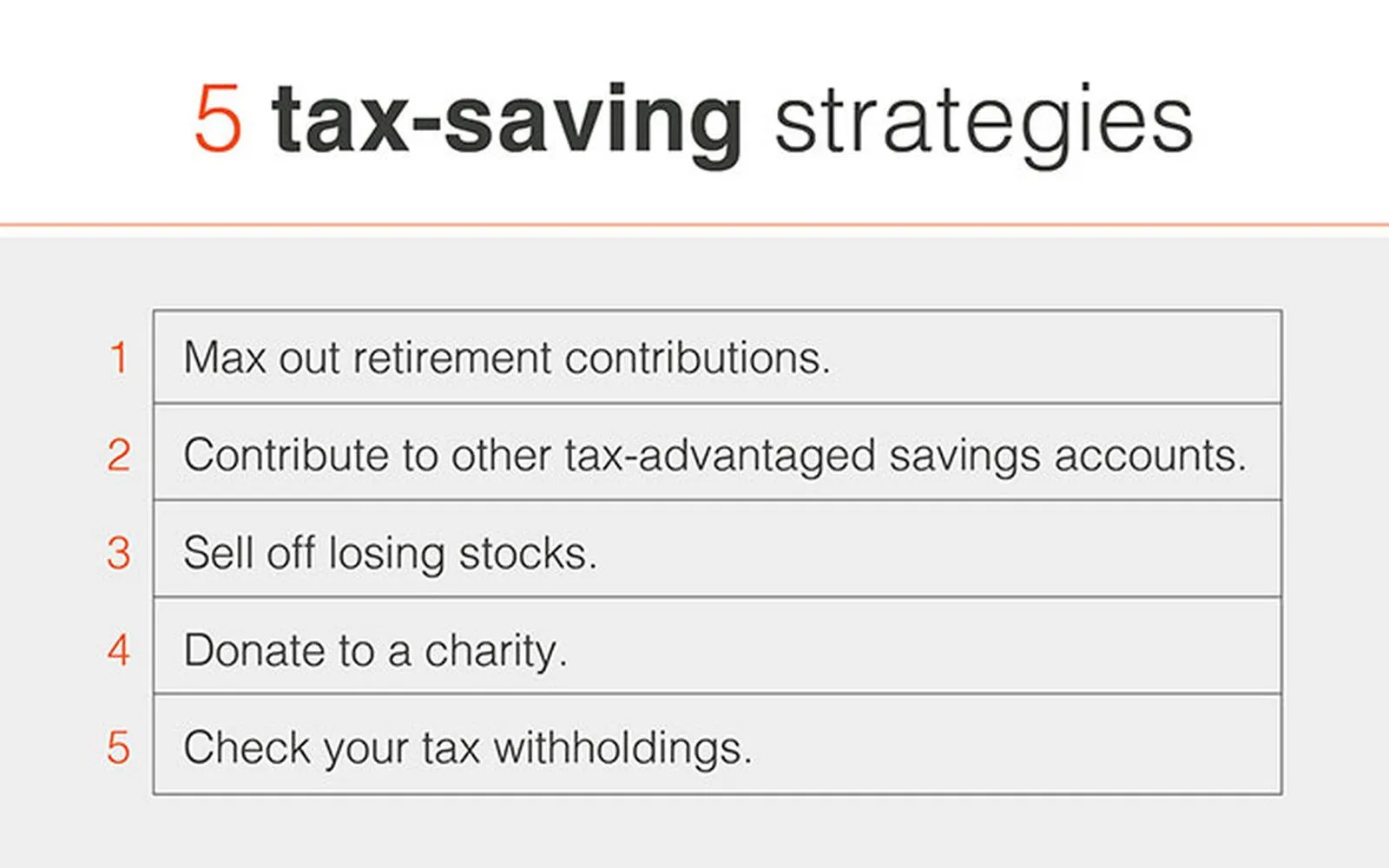

- Tax Efficiency: Some robo-advisors offer tax-loss harvesting and other strategies to minimize your tax burden, making them more appealing for long-term investors.

- User Experience: A user-friendly interface can greatly enhance your experience. Look for platforms that are intuitive and easy to navigate.

- Customer Support: Although robo-advisors are automated, having access to knowledgeable customer support can be invaluable, especially for new investors.

Chart: Comparison of Popular Robo-Advisors in 2025

| Robo-Advisor | Fees | Account Minimum | Tax-Loss Harvesting | Investment Strategy |

|---|---|---|---|---|

| Wealthfront | 0.25% | $500 | Yes | Passive Indexing |

| Betterment | 0.25% | $0 | Yes | Goal-Based Investing |

| SoFi Invest | 0% | $1 | No | Self-Directed & Automated |

| Ellevest | 0.25%-0.50% | $0 | Yes | Women-Focused Investing |

Evaluating Investment Goals

Before selecting a robo-advisor, it is essential to clearly define your investment goals. Are you saving for retirement, a home, or perhaps your child’s education? Each goal may require a different investment strategy. Assess whether the robo-advisor can align its services with your specific objectives, risk tolerance, and time horizon.

Research and Reviews

In 2025, the online landscape is filled with reviews and comparisons of robo-advisors. Utilize these resources to gauge user experiences and overall satisfaction. Pay attention to what existing customers have to say about the platform’s performance, customer service, and ease of use. Websites that provide detailed analyses can be particularly helpful in making an informed decision.

Security and Regulation

As you consider your options, it’s vital to examine the security measures employed by each robo-advisor. Ensure that the platform is registered with regulatory bodies and utilizes encryption and security protocols to protect your personal and financial information. In 2025, data security is more important than ever, so choose a platform that prioritizes your safety.

Final Thoughts

Choosing the right robo-advisor is a significant step in your investment journey. By considering the features outlined in this guide and evaluating your investment goals, you can find a platform that meets your needs. As technology continues to evolve, robo-advisors will become even more sophisticated, making it essential to stay updated on the latest developments in the field. Take your time, do your research, and make a choice that aligns with your financial aspirations.

Explore

Free Business Checking Accounts: A Smart Choice for Small Businesses

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth

Guide to Finding the Best Retirement Advisor for 2025

Best Passive Income Ideas to Grow Your Wealth in 2025

Maximize Your Wealth: The Ultimate Guide to Passive Investment Strategies for 2025

Top Investment Apps for Beginners in 2025: Your Guide to Smart Investing

10 Smart Tax-Free Savings Tips Every American Needs in 2025

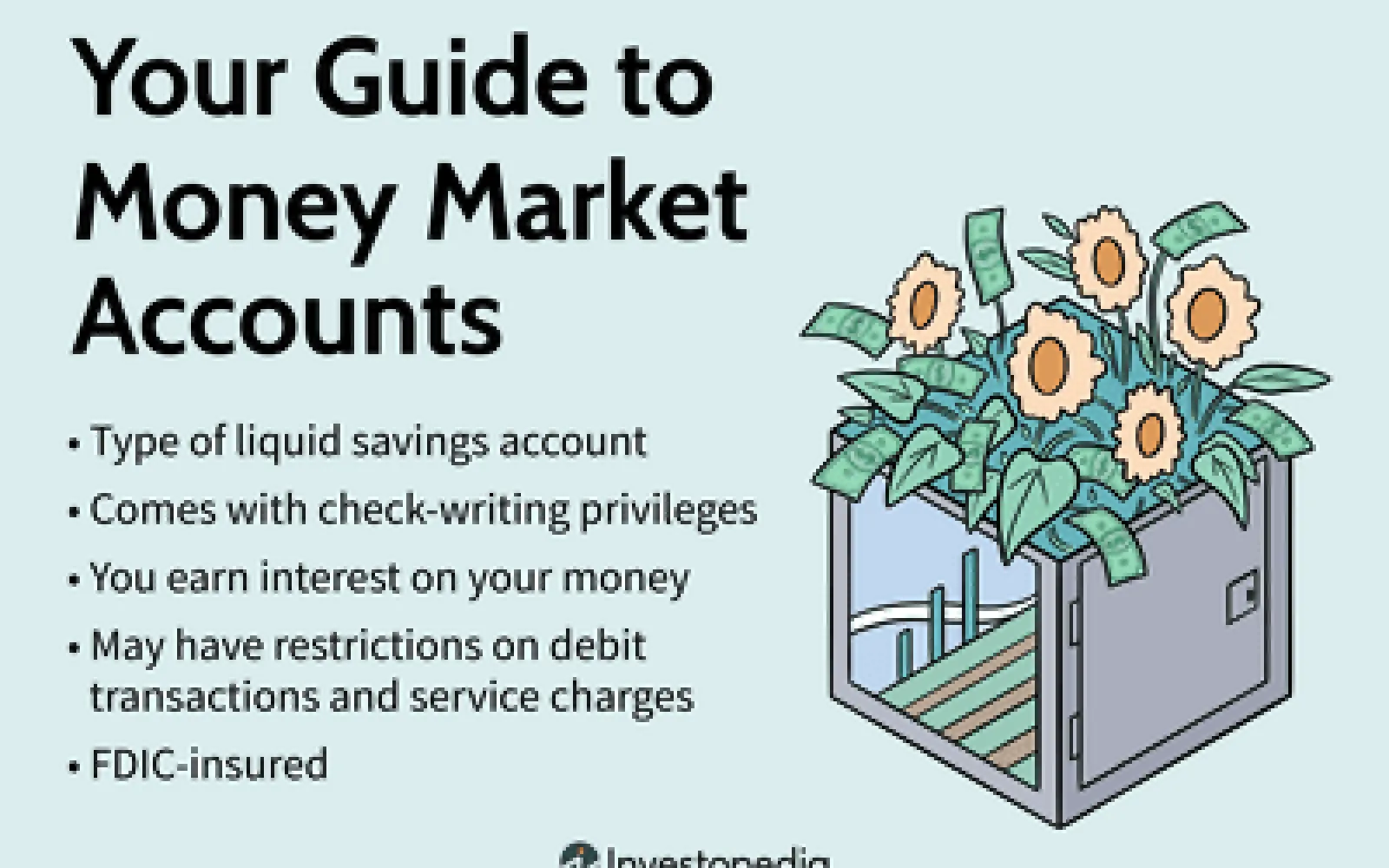

Money Market Funds: Smart Savings for Short-Term Goals