Best Passive Income Ideas to Grow Your Wealth in 2025

Discover the best passive income ideas to enhance your financial growth in 2025. From real estate investments to dividend stocks, explore various strategies that require minimal effort while generating consistent revenue. Embrace opportunities like peer-to-peer lending and digital products to build a sustainable income stream and secure your financial future.

In today's ever-evolving financial landscape, passive income has become a key strategy for individuals looking to grow their wealth without the need for constant effort. As we approach 2025, it’s essential to explore the best passive income ideas that can help you build a sustainable financial future. Below, we delve into several promising avenues for earning passive income and provide a chart for a quick reference on their potential returns.

1. Real Estate Investment

Investing in real estate remains one of the most reliable forms of passive income. With the continuous demand for housing, rental properties can provide a steady stream of income. You can choose to invest in residential, commercial, or vacation rentals, depending on your risk tolerance and financial goals. The key is to conduct thorough market research to identify lucrative properties.

2. Dividend Stocks

Dividend stocks are shares in companies that return a portion of their profits to shareholders. These stocks are particularly appealing for long-term investors seeking passive income. By building a diversified portfolio of dividend-paying stocks, you can create a reliable income source. Look for companies with a track record of increasing dividends over time.

3. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect borrowers with investors willing to lend money at competitive interest rates. By investing in P2P lending, you can earn interest on loans you provide, creating a stream of passive income. However, it’s crucial to assess the risks involved, as some borrowers may default on their loans.

4. Create an Online Course

If you possess expertise in a specific field, consider creating an online course. Platforms like Udemy and Teachable allow you to reach a large audience while enjoying the benefits of passive income. Once you've created and uploaded your course, you can earn money from students enrolling without needing to actively participate.

5. High-Yield Savings Accounts and CDs

For those who prefer a more conservative approach, high-yield savings accounts and certificates of deposit (CDs) offer a safe way to generate passive income. These financial products typically provide higher interest rates compared to traditional savings accounts, allowing your money to grow with minimal risk. While the returns may not be as high as other investments, they are a reliable way to earn interest.

6. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for each sale made through your referral. By creating a blog or a social media presence focused on a niche, you can generate passive income by sharing affiliate links. The key to success in affiliate marketing is building a loyal audience and consistently producing quality content.

7. Create a Mobile App

With the increasing reliance on mobile technology, creating a mobile app can be a lucrative venture. Once developed, a well-designed app can generate income through ads, subscriptions, or in-app purchases. If you have a unique idea that meets a specific need, investing time in app development can yield significant returns.

8. Invest in Index Funds

Index funds are mutual funds or exchange-traded funds (ETFs) designed to track a specific index, such as the S&P 500. Investing in index funds offers diversification and lower fees compared to actively managed funds. Over time, they can provide substantial passive income through capital appreciation and dividends.

Passive Income Ideas Comparison Chart

| Passive Income Idea | Initial Investment | Potential Returns | Risk Level |

|---|---|---|---|

| Real Estate | High | 8-12% annually | Medium |

| Dividend Stocks | Medium | 4-8% annually | Medium |

| Peer-to-Peer Lending | Low | 5-15% annually | High |

| Online Course | Low | Variable | Low |

| High-Yield Savings | Low | 0.5-2% annually | Low |

| Affiliate Marketing | Low | Variable | Medium |

| Mobile App | Medium to High | Variable | High |

| Index Funds | Medium | 7-10% annually | Low |

9. Invest in a Business

Becoming a silent partner in a business can generate passive income. By investing in a startup or small business, you can receive dividends or a percentage of the profits without being involved in daily operations. However, it's essential to perform due diligence and understand the business model before investing.

In conclusion, the landscape of passive income is rich with opportunities in 2025. Whether you choose to invest in real estate, stocks, or create online content, diversifying your income streams is crucial. By exploring these options, you can set yourself up for financial success and enjoy the benefits of earning money while you sleep. Start today, and watch your wealth grow over time!

Explore

Mastering Your Income Tax: The Ultimate Guide to Online Advice

Get Your Dream Home: How to Sell Your House Fast and Move On to Your Next Adventure

Unlocking Connectivity: Your Guide to the Best Business Internet Providers in Your Area

Maximize Your Wealth: The Ultimate Guide to Passive Investment Strategies for 2025

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth

Top Business Loans for Women Entrepreneurs in 2025: Unlock Your Potential and Grow Your Business

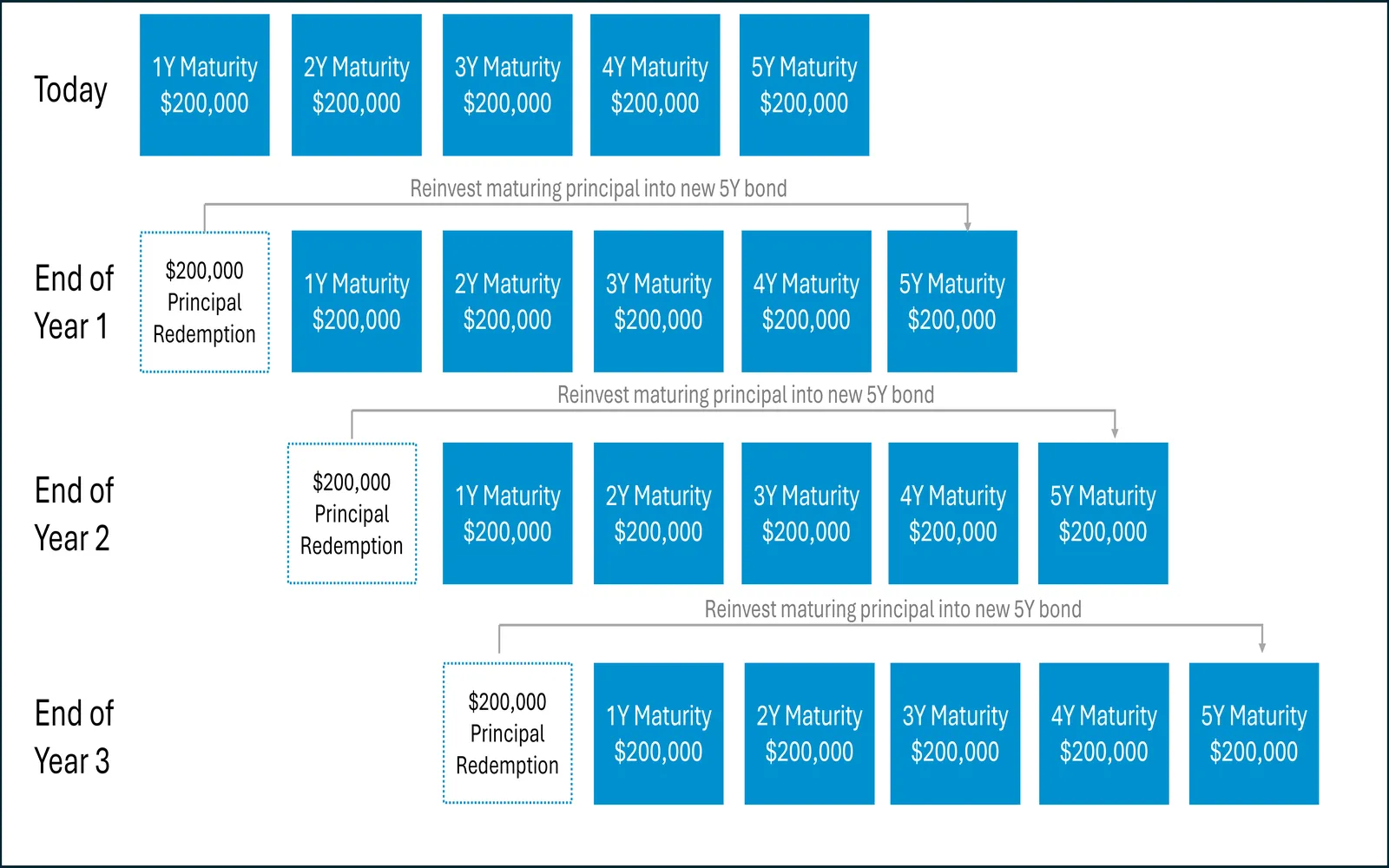

How to Use Bond Ladders for Stable Retirement Income in 2025

How to Choose a Robo Advisor: Smart Wealth Tools in 2025