Investing in Nasdaq 100 ETFs for Long-Term Success

Investing in the Nasdaq 100 ETFs can be a strategic move for those looking to achieve long-term financial success. The Nasdaq 100 index comprises 100 of the largest non-financial companies listed on the Nasdaq stock exchange, including major players in technology, consumer services, healthcare, and more. By investing in ETFs that track this index, investors can gain exposure to a diversified portfolio of prominent stocks, which can help mitigate risk while enhancing potential returns.

Understanding Nasdaq 100 ETFs

Exchange-Traded Funds (ETFs) are investment funds that are traded on stock exchanges, much like individual stocks. Nasdaq 100 ETFs specifically aim to replicate the performance of the Nasdaq 100 index. Popular examples include the Invesco QQQ Trust (QQQ) and the ProShares Ultra QQQ (QLD). These ETFs typically offer lower expense ratios compared to mutual funds, making them an attractive option for long-term investors.

The Advantages of Investing in Nasdaq 100 ETFs

There are several compelling reasons why investing in Nasdaq 100 ETFs can be beneficial for long-term investors:

- Diversification: By investing in an ETF that tracks the Nasdaq 100, investors gain exposure to a wide range of companies across various sectors, reducing the risk associated with investing in individual stocks.

- Growth Potential: The Nasdaq 100 is heavily weighted towards technology and innovative companies, which have shown significant growth potential over the years. This focus can lead to higher returns compared to more traditional investment options.

- Liquidity: Nasdaq 100 ETFs are traded on major exchanges, providing high liquidity. This makes it easier for investors to buy and sell shares without impacting the market price significantly.

- Cost-Effective: With generally lower expense ratios than mutual funds, ETFs can be a more cost-effective way to invest, allowing more of your money to work for you over time.

Long-Term Performance of Nasdaq 100 ETFs

The historical performance of the Nasdaq 100 index has been impressive. Over the past decade, it has outperformed many other indices, driven largely by the success of technology giants like Apple, Amazon, and Microsoft. Here’s a chart illustrating the performance of a popular Nasdaq 100 ETF over the last ten years:

This chart highlights the potential for significant returns that long-term investors can expect when committing to Nasdaq 100 ETFs. However, it's important to remember that past performance is not indicative of future results.

Key Considerations Before Investing

While investing in Nasdaq 100 ETFs can be advantageous, there are several key considerations to keep in mind:

- Market Volatility: The technology sector, which dominates the Nasdaq 100, can be highly volatile. Investors should be prepared for fluctuations in value and consider their risk tolerance before diving in.

- Investment Horizon: Nasdaq 100 ETFs are best suited for investors with a long-term horizon. Short-term traders may find the daily fluctuations challenging and may not benefit from the index's long-term growth.

- Research and Due Diligence: Before investing, it's crucial to conduct thorough research. Look into the specific ETF’s expense ratio, holdings, and historical performance to ensure it aligns with your investment goals.

Strategies for Investing in Nasdaq 100 ETFs

To maximize the potential benefits of investing in Nasdaq 100 ETFs, consider implementing the following strategies:

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. This can reduce the impact of market volatility and lower the overall cost of investment over time.

- Rebalancing Portfolio: Regularly review and rebalance your investment portfolio to ensure it aligns with your financial goals and risk tolerance. This may involve adjusting your holdings in Nasdaq 100 ETFs as market conditions change.

- Stay Informed: Keep up with market trends, economic indicators, and news related to the companies within the Nasdaq 100 index. Staying informed will help you make better investment decisions.

Conclusion

Investing in Nasdaq 100 ETFs can be a powerful tool for achieving long-term financial success. With their potential for high returns, diversification, and cost-effectiveness, they offer a compelling option for investors looking to harness the growth of leading companies in the technology sector and beyond. By understanding the advantages and risks, employing effective strategies, and remaining informed, investors can position themselves for long-term success in the dynamic world of stock market investing.

Explore

A Complete Guide to Investing in ETFs in 2025

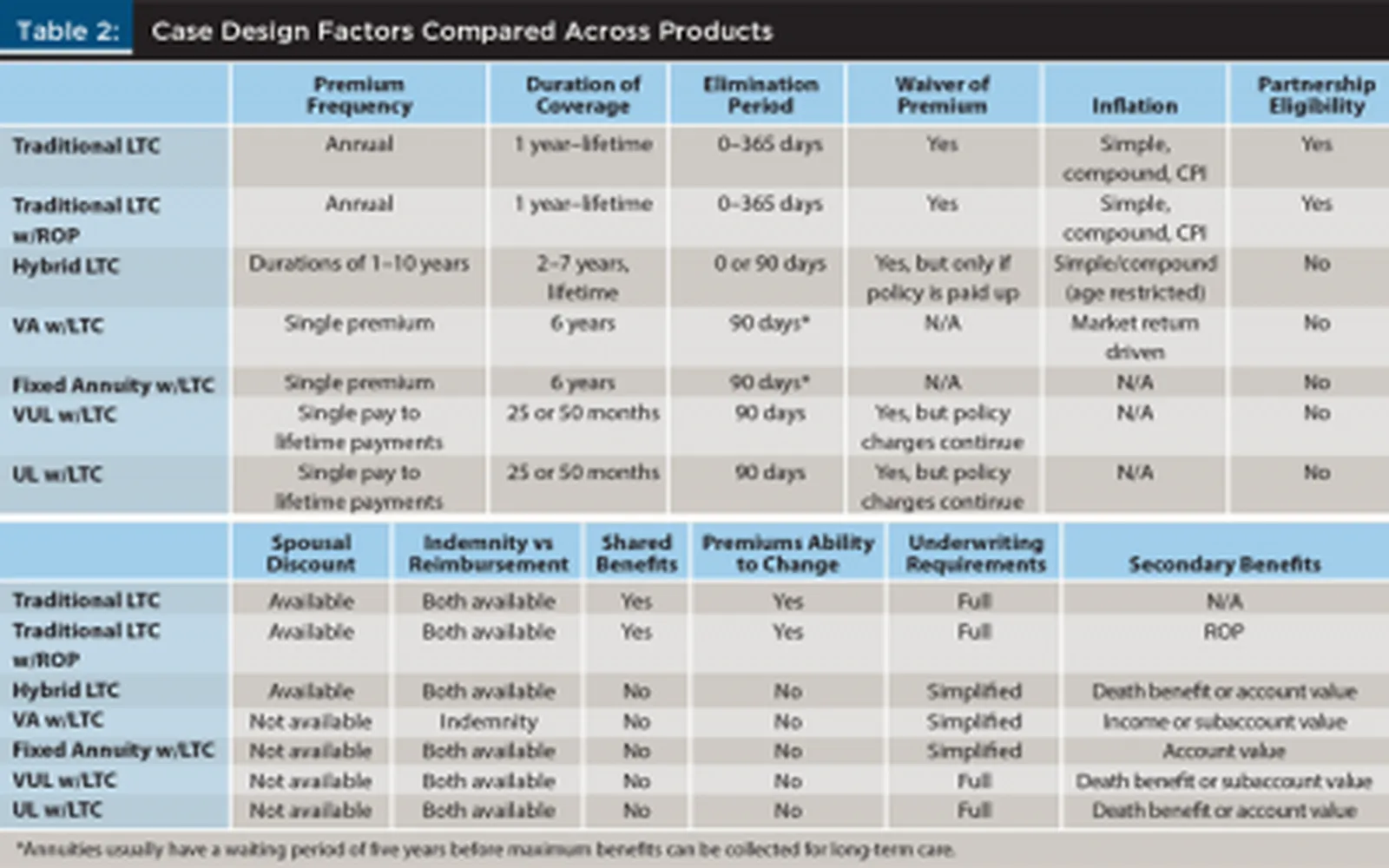

Top Long-Term Care Insurance Options for 2025: Secure Your Future Today

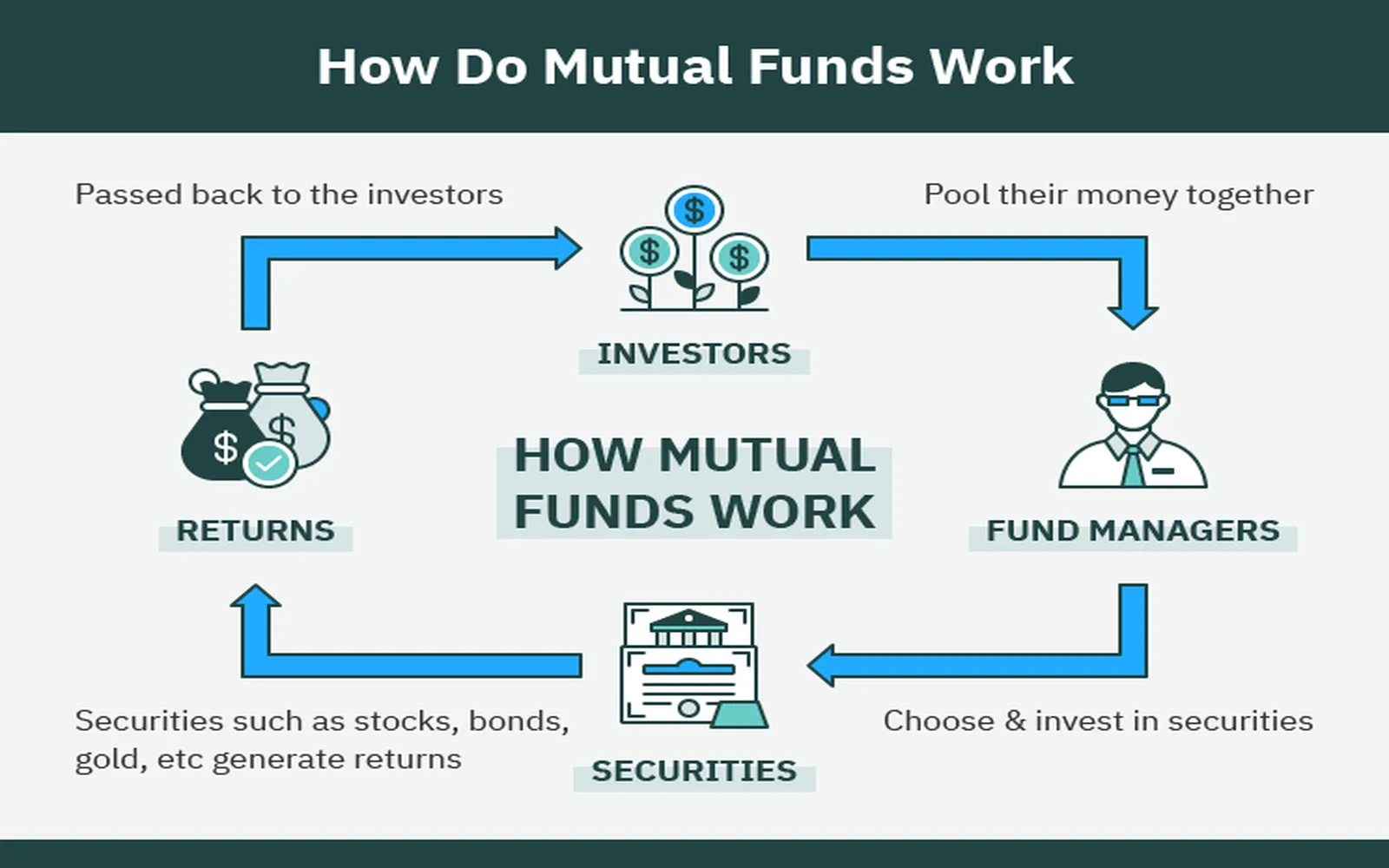

Your Ultimate Guide to Investing in Mutual Funds in 2025: Strategies for Success

Tax-Efficient Investing 2025: Maximize Your Returns and Minimize Taxes

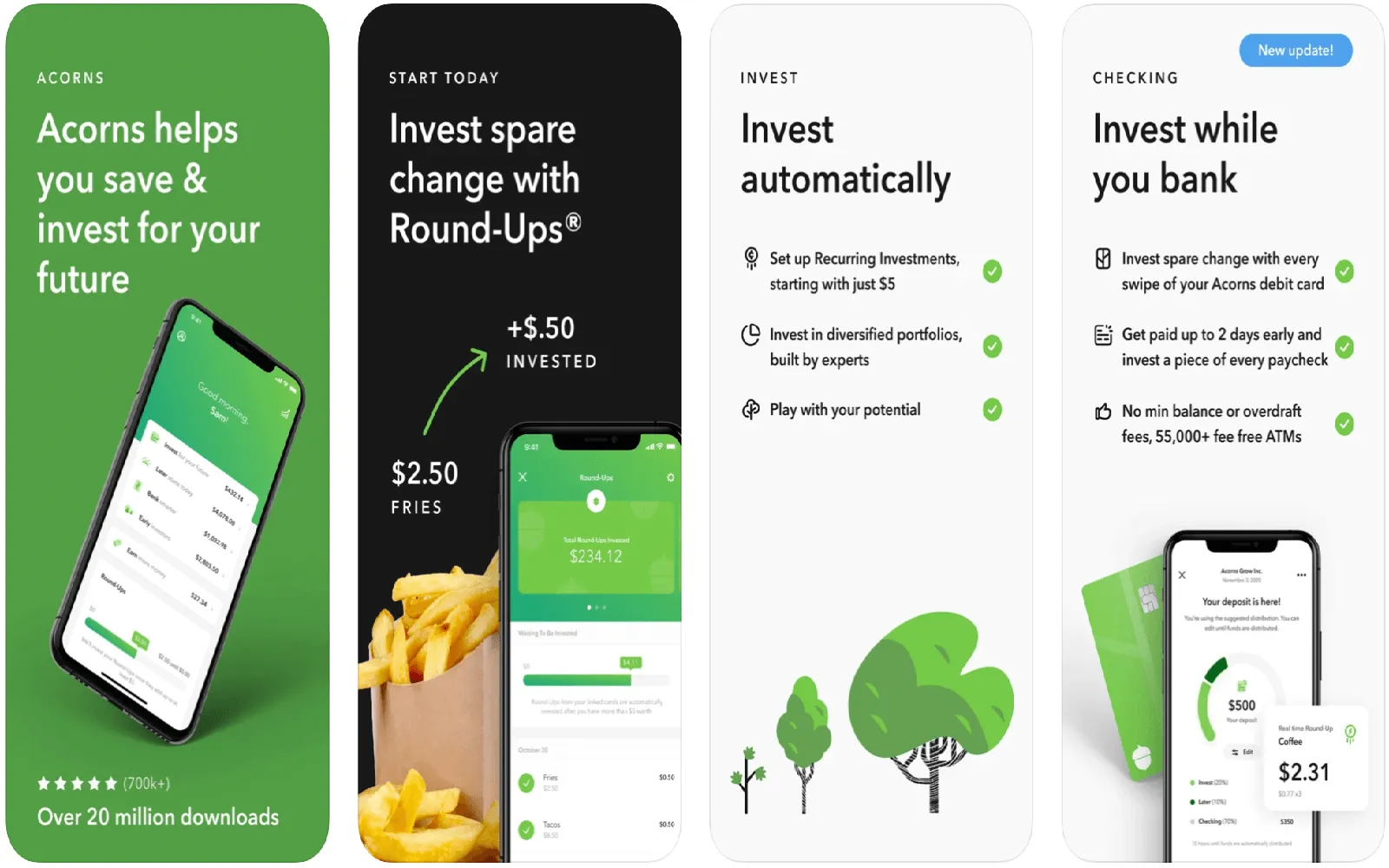

Top Investment Apps for Beginners in 2025: Your Guide to Smart Investing

Smart Investing in 2025: How to Start with Little Money and Grow Your Wealth

ESG Investing in 2025: Strategies for Sustainable Growth and Ethical Returns

Money Market Funds: Smart Savings for Short-Term Goals